Invest and Earn Without Paying Capital Gains Tax

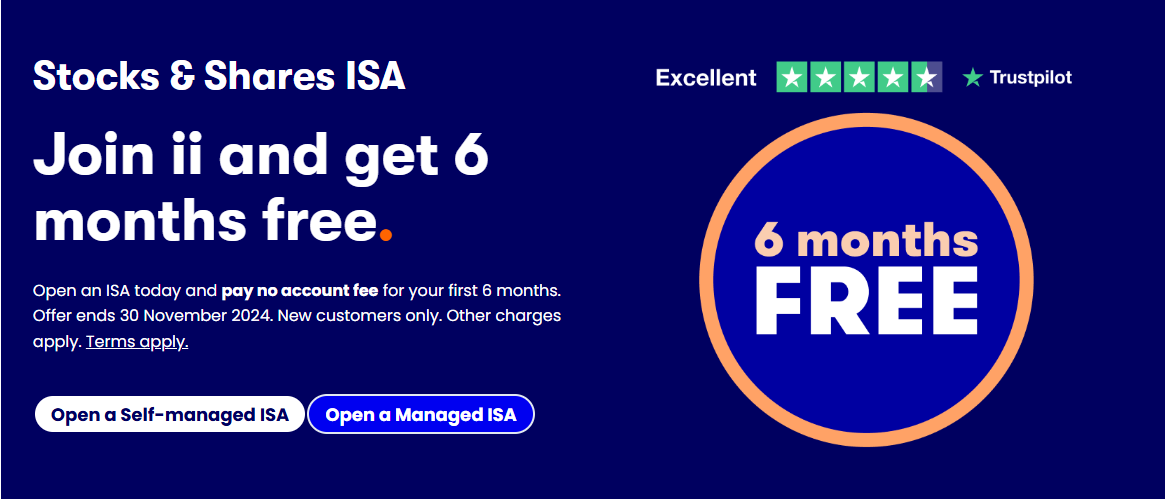

Stocks and Shares ISA

Are you looking to maximize your savings while enjoying significant tax benefits? With a Stocks and Shares ISA, you can invest in a wide range of assets and enjoy tax-free returns on your investment growth.

What is a Stocks and Shares ISA?

A Stocks and Shares ISA is a tax-efficient investment account that allows you to invest in stocks, bonds, and other assets. The UK government provides this scheme to encourage individuals to save and invest, making your investment gains free from Capital Gains Tax.

Key Features:

- Tax-Free Investment Growth: Any profits you earn from your investments in a Stocks and Shares ISA are free from Capital Gains Tax.

- Annual Investment Limit: You can invest up to £20,000 each tax year, allowing for substantial savings growth.

- Wide Range of Investment Options: Choose from various investment types, including individual stocks, mutual funds, ETFs, and bonds.

Who Can Open a Stocks and Shares ISA?

You can open a Stocks and Shares ISA if you meet the following criteria:

- Age: You must be at least 18 years old.

- Residency: You must be a UK resident or a Crown servant. You can be on a student or working visa and still open an ISA account.

- You cannot open an ISA account if you are in the UK on a seasonal visa, visit visa, or have Refugee status.

How Does a Stocks and Shares ISA Work?

- Open Your Account: Choose a provider and complete the application process online, you can visit this link for more information.

https://www.ii.co.uk/ii-partners/mimikconsultancy - Select Your Investments: Choose from a diverse range of investment options that suit your risk appetite and financial goals.

- Contribute Up to £20,000: Deposit up to £20,000 per tax year into your ISA and watch your investments grow. You can start by investing as low as you want even just £25!

- Enjoy Tax-Free Returns: Any gains made within the ISA are tax-free, maximizing your investment potential.

Benefits of a Stocks and Shares ISA

- Capital Gains Tax Exemption: Keep all your investment gains without worrying about capital gains tax.

- Diverse Investment Portfolio: Access a wide array of investments, allowing for diversification and risk management.

- Long-Term Growth Potential: Stocks have historically provided higher returns over the long term compared to other savings accounts.

- Flexibility: You can manage and adjust your investments according to market conditions and personal financial goals.

How to Get Started with a Stocks and Shares ISA

- Choose Your Provider: Research different ISA providers to find one that fits your needs, taking into consideration fees and available investment options.

- Complete Your Application: Fill out the necessary forms online to open your Stocks and Shares ISA.

- Fund Your Account: Transfer money into your ISA up to the annual limit of £20,000.

- Select Investments: Choose how to allocate your funds among various investments.

- Monitor Your Investments: Keep an eye on your portfolio and adjust as needed to align with your financial goals.

Frequently Asked Questions (FAQs)

- What is the minimum amount I must invest? You can invest any amount you want and can even start with as low as £10.

- Can I take out my money? Yes, you can withdraw your money and put it into your bank account any time you want.

- What happens if I exceed the £20,000 limit? Contributions above the limit will be returned to you, and you may incur penalties. Every time you put money into your ISA account from an external source, it counts towards the £20,000, even if you take the money out.

- Can I transfer an existing ISA into a Stocks and Shares ISA? Yes, you can transfer funds from other ISAs into a Stocks and Shares ISA without losing your tax benefits.

- What fees are associated with a Stocks and Shares ISA? Fees vary by provider and may include management fees, trading fees, and other charges. Always check the fee structure before selecting a provider.

Is a Stocks and Shares ISA Right for You?

A Stocks and Shares ISA is an excellent option if you are looking for long-term investment growth and are comfortable with the risks associated with investing in the stock market. If you want to take advantage of tax-free returns and grow your wealth effectively, this could be the right choice for you.

Get Started Today!

Don’t miss out on the opportunity to grow your savings tax-free. Open your Stocks and Shares ISA today and start your journey toward financial freedom.

Visit this link to start today: https://www.ii.co.uk/ii-partners/mimikconsultancy

Disclaimer: This initiative is part of the ISA services offered by the UK Government. This content is for informational purposes only and does not constitute financial advice. Please consider seeking independent financial advice before making investment decisions.